What Is a Payment Gateway and How It Can Benefit Your Business

When operating an eCommerce store, ensuring a seamless shopping experience for customers is essential to increase sales. The right payment gateway can help you achieve that by securing transactions and simplifying the checkout process.

Despite that, most people are still not familiar with this technology. For that reason, this article will explain what a payment gateway is, how it works, and why your online business will benefit from having one.

In addition, we’ll also share a list of the top seven eCommerce payment gateways that can help you generate more sales online.

Download Business Plan Template

What Is a Payment Gateway?

A payment gateway is a service that authorizes credit card payments for both online and offline businesses. For eCommerce sites, it also ensures a secure payment flow by encrypting the customer’s financial information before transferring it to the merchant’s account.

How Payment Gateways Work

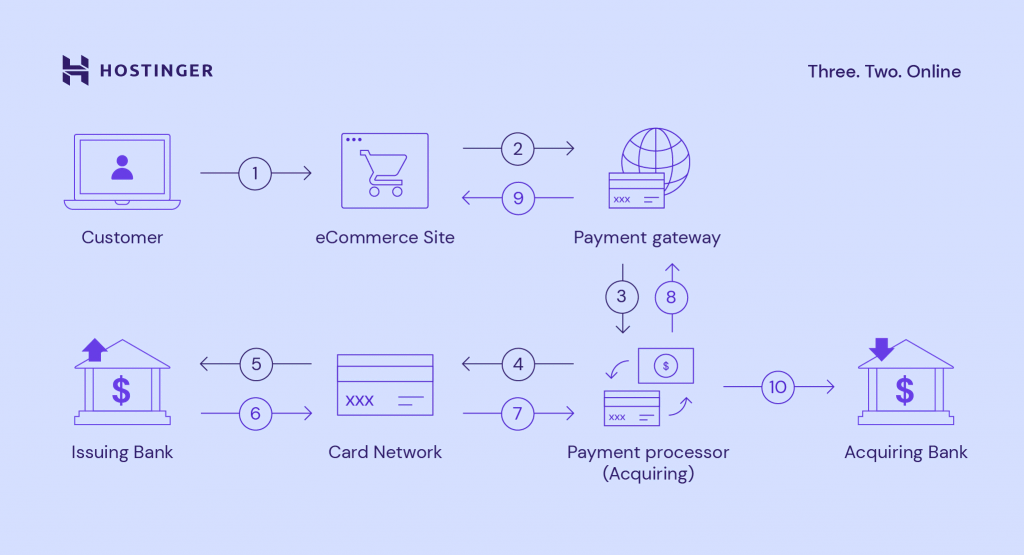

To better understand how payment gateways work, let’s discuss some of the stakeholders involved:

- Merchant. Someone who owns and operates an eCommerce business.

- Customer. Also known as a cardholder, it’s the one that initiates the transaction by purchasing products or services from the merchant.

- Card network. The company in charge of managing fund transfers between merchants and customers. Some of the major card network companies include Visa, Mastercard, and American Express.

- Issuing bank. A bank that issues payment cards to customers on behalf of the card networks.

- Acquiring bank. An acquiring bank provides merchant accounts to business owners. It processes payments from the issuing bank on behalf of the merchant.

Here’s an overview of how a payment gateway works during online payments.

- Customers complete orders on an eCommerce site. The site will direct customers to a payment gateway where they enter payment information like their debit card details.

- After receiving the information, the payment gateway will perform fraud checks and encrypt it using built-in security protocols, namely Transport Layer Security (TLS).

- The payment gateway transmits the encrypted information to the merchant’s acquiring bank processors.

- The processor then passes it to the customer’s card network.

- The card network forwards the transaction to the customer’s issuing bank.

- The issuing bank will check if there’s a sufficient balance on the customer’s bank account and send the authorization response back to the card network.

- The card network informs the processor whether the request was approved or declined.

- The payment gateway receives the response from the processor.

- The payment gateway passes this response back to the eCommerce site to let the customer complete the transaction.

- If the transaction is completed, the customer will be notified, and the acquiring bank will deposit all of the authorized funds in the merchant’s account. However, if the transaction fails, the site will ask the customer to use another payment method.

Payment Gateway vs Payment Processor

While payment gateways and payment processors work together during the transaction, these payment service providers play different roles.

A payment processor acts as a liaison that transmits transaction information between the merchant, issuing bank, and acquiring bank. Its main purpose is to secure payment processing from user authentication to fund settlement.

Typically, a processor also provides credit card machines and other equipment necessary to accept payments. However, you need to choose a payment service provider and create a merchant account.

For in-person purchases, a processor will use a terminal as its point of sale.

On the other hand, a payment gateway serves as a middleman that approves or declines transactions between merchants and customers. It’s an online point of sale for your eCommerce store.

If the processor focuses on card-present payments, a payment gateway enables merchants to accept payments where a card doesn’t have to be present.

Types of Payment Gateways

After understanding the difference between a payment processor and a gateway, it’s also important to know the different types of payment gateways.

Generally, there are three types of payment gateways available:

- Redirection. Also known as a hosted payment gateway, it redirects the customer to the payment service providers (PSPs) page to complete the transaction. This type is ideal for someone just starting an online business since it has a simple setup process and doesn’t require a merchant account.

- On-site checkout, off-site payment. The checkout process takes place on the merchant’s site, but the payment is handled by a third-party payment gateway. While it allows a faster payment process, it doesn’t offer full technical support like a hosted service.

- On-site checkout and payment. This payment gateway lets customers enter their payment details directly on the merchant’s website. It comes with more customization and integration options, but the merchant needs to obtain an SSL certificate.

Pro Tip

When using a hosted payment page, also known as third-party checkout, ensure that the page is consistent with the rest of your eCommerce site’s design. This will help create a more seamless shopping experience for your customers.

Why Should You Use a Payment Gateway Service?

Here are some of the benefits that payment gateways offer for online businesses:

- Better security. It protects sensitive data and secures transactions with encryption protocols, and ensures compliance with the Payment Card Industry Data Security Standard (PCI-DSS).

- Fraud-prevention. Reduces the risk of information loss and identity theft by using fraud screening tools, including CVV (Card Verification Value), AVS (Address Verification Service), and 3-D Secure.

- Larger customer base. Supports cross-border online payments, making it easier for sellers to operate their eCommerce business internationally and make more money online.

- Faster transaction. Provides several features to ensure a seamless and rapid payment process.

7 Best Payment Gateway Providers for eCommerce Businesses

When making your eCommerce website, it’s important to choose the right payment gateway provider.

We’ve compiled a list of top-ranking payment gateway providers based on their key features, pros and cons, and pricing.

1. PayPal

PayPal is a widely-known payment gateway provider that can act as both a payment gateway and processor. Aside from being easy to use, it is also packed with various features for requesting and accepting payments.

Pros:

- Easy setup. Users can quickly connect PayPal to their eCommerce site.

- Supports international payments. It is available in more than 200 countries and regions, making it one of the best options for international fund transfers.

- Seller protection program. Under this program, PayPal can help qualified merchants resolve transaction issues.

Cons:

- Interruptions in the checkout process. Since PayPal uses redirection, customers need to navigate to another page to complete their payment. Plus, the auto-return feature is only available for business accounts.

- Frequent phishing target. PayPal users are often targeted by scams. In some cases, you may receive fake PayPal emails that contain phishing links.

PayPal’s merchant fees depend on your location, payment methods accepted, and currency. If you use PayPal Online Card Payment Services, for example, the transaction fee goes from 2.59% to 3.09%, plus a fixed amount.

2. Stripe

Another reputable online payment gateway is Stripe, which facilitates credit and debit card payments for all business types.

Pros:

- Financial reporting. Using Stripe Sigma, users will receive comprehensive reports with insights for improving their operations.

- Multi-currency payments. Enable global transactions by accepting payments in over 135 currencies. It also supports various payment methods, including one-click checkout, mobile payment, and credit card payment.

- Compatibility. This payment gateway integrates well with major eCommerce platforms and third-party services, including analytics, finance, and marketing tools.

Cons:

- Technical knowledge needed. Non-tech users may find it hard to navigate its APIs and developer tools.

- Payout delay. It takes 7-14 days for sellers to receive payments in their accounts.

While there are no initial setup fees, Stripe charges 2.9% + $0.30 from each successful card charge.

Pro Tip

Stripe does not offer a native plugin. However, you can set up Stripe for WordPress websites using third-party plugins.

3. Square

Square is another platform that makes settling payments easier for merchants. It offers an advanced and feature-rich solution for accepting mobile credit card payments.

Pros:

- Free POS. Square’s point-of-sale system is free to use and has several great features. For instance, retailers can create professional-looking invoices and track item inventory.

- All-in-one payment. Various payment options are available, including recurring payments, invoicing, credit or debit card payments, and contactless payments.

- Virtual terminal. Insert credit card details directly via web-connected devices.

- Clean-looking dashboard. Square also provides a payment dashboard that serves as a central hub for all your payment activities.

Cons:

- Weak customer support. Square can often terminate a merchant account when problems arise with third-party payment processing without adequate explanations.

- Not cost-effective for large businesses. The flat-rate pricing system may be costly for businesses with higher transaction volumes.

Square charges transaction fees of 2.6% + $0.10 for card-present transactions and 2.9% + $0.30 for card-not-present payments online.

4. Apple Pay

Apple Pay is a fast and reliable payment gateway solution designed for mobile payments. It allows you to accept credit cards and other electronic payments as long as your store has a near-field communication (NFC) terminal.

Pros:

- Quick checkout. Customers can quickly complete their purchases with a single click. There’s no need to create a form to collect the cardholder data.

- Built-in privacy and security features. The anonymized digital token system and EMVCo adoption make Apple Pay one of the most secure payment solutions.

Cons:

- Difficult adoption. Merchants need an NFC terminal to use the service.

- Compatibility issues. Depending on where your audience is located, their device may not be compatible with this payment gateway.

5. Amazon Pay

Amazon Pay is a popular and highly secure platform for processing online payments. With its checkout option, merchants can easily receive payments from Amazon customers.

Pros:

- Voice-based transactions. Enable customers to shop using Alexa-powered devices.

- Highly responsive. Improve the checkout experience for web and mobile devices to reduce card abandonment.

- Discounts for non-profits. Amazon Pay offers discounted rates for qualified non-profit organizations, providing a great way to accept donations without high processing costs.

Cons:

- Difficult merchant account approval. A common issue with Amazon Pay is it requires retailers to submit additional documentation after approval.

- Limited functionality for in-person business. This payment gateway service doesn’t offer tools for in-person payments. Consider another option on the list if you want a comprehensive payment solution.

Amazon Pay‘s transaction fee includes domestic processing and authorization charges plus taxes.

6. Authorize.net

Authorize.net is an online payment gateway designed by Visa. Using it, merchants can quickly accept card and non-card payments and transfer funds to a business bank account.

Pros:

- Integrations. Authorize.net works with a wide variety of processors, POS systems, and prominent card companies, making it easy for merchants to add payment methods.

- Feature-rich. It comes with fraud detection, automatic account updates, and eCheck processing.

Cons:

- Geographical restrictions. The service is available only to businesses in specific countries like the US, UK, Canada, and Australia.

- Monthly fee. Authorize.net charges a $25 monthly gateway fee plus an all-in-one transaction charge of 2.9% + $0.30 per transaction. So, those who want to keep the cost low can opt for another gateway with a free merchant account that has no monthly charge.

7. Helcim

Helcim’s payment gateway offers a flexible billing structure and an easy-to-use interface. With a Helcim merchant account, you can accept customer payments in-person and online.

Pros:

- Transparent pricing. Helcim doesn’t have hidden costs or contract obligations. Users don’t have to worry about paying monthly, setup, payment card industry (PCI), or cancellation fees.

- Cross-platform compatible. Merchants can access Helcim’s payments app via Windows, macOS, smartphones, and tablets.

- Great customer support. Helcim offers responsive customer service via phone, email, and tickets.

Cons:

- Limited third-party POS hardware integrations. The system does not support third-party terminals.

- Not suitable for high-risk industries. Merchants with a low personal credit score or high-risk business profile will find it difficult to get their accounts approved.

Helcim’s fees depend on the monthly volume of credit card payments accepted by your business. On average, they cost 2.4% + $0.25 per online transaction.

Conclusion

Considering the rise of online shopping and the adoption of digital payments, installing a payment gateway on your eCommerce site is essential to facilitate online transactions.

In this article, we’ve covered everything you need to know about payment gateways, from how they work to their benefits. Moreover, we listed the best payment gateways so you can decide which one is right for your business.

Keep in mind that payment gateways alone won’t guarantee the success of your online business. It’s also important to stay up-to-date with currently trending products.

We hope you find this article insightful. If you have any questions, feel free to leave them in the comment section below.

What Is a Payment Gateway FAQ

Now that you’ve learned what is a payment gateway and how it functions, we’ll provide the answer to some of the most commonly asked questions about it.

How Much Does an Online Payment Gateway Cost?

The price of setting up a payment gateway depends on the payment service provider.

Most payment gateways have a transaction-based pricing structure, which may charge your business from 2.4% to over 3% plus a fixed amount per transaction. Additional fees may include monthly, chargeback, and merchant account setup charges.

How Do I Create a Payment Gateway?

It takes a lot of time and effort to build your own payment gateway. It involves choosing the payment server, integrating with a processor, creating a customer database, and implementing legal and security requirements like tokenization, EMV, and PCI DSS.

According to EPAM, creating a functional payment gateway would cost $300,000-400,000. However, if you’re low on budget and want to save time, consider simple and cheaper alternatives like partnering with a payment service provider or using a white-label service.

What Does White Label Payment Gateway Mean?

White label payment gateways let businesses add their own branding to their payment processing service while using third-party payment gateway providers.

What Are ECOM and POS?

ECOM stands for electronic commerce and refers to every transaction done via eCommerce platforms. It includes online tools and activities ranging from electronic wallets to internet banking.

A point-of-sale (POS) is the place or platform where you process and execute customer purchases.

What Is ATM in eCommerce?

An automated teller machine (ATM) is a system that enables consumers to process payments to eCommerce merchants without having to deal with bank representatives.